Bogleheads style - summary

Early on after started making money, I actually did try out active investing (robinhood, stock picking, building models for automated trading, etc) but quickly realized:

- It is hard to make sustainable money with an active trading (Most of short term gains were due to luck, I definitely was not skilled)

- More importantly, I actually was not super interested in spending lots of my free time thinking about active spending.

The latter point is really what attracted me to the Bogleheads investing approach. And the fact that it’s simple and intuitive means it’s accessible to people who lack personal finance knowledge.

You can find everything you need to know about the investment style in bogleheads.org. In this doc, I am providing my version of simplified summary.

TLDR

- Pay off any debt as soon as possible (exception to low interest rate ones like mortgage)

- Maintain 6 months living expense worth of emergency savings

- Ensure you are taking advantage of employer 401k match (free money)

- Keep investing simple and boring:

- No need to time the market and chase marginal returns.

- You can achieve 90th percentile return (after tax & fee) performance with simple index funds.

Investing

Investing prioritization

- Emergency fund

- 401k match

- Pay off credit card debt

- HSA

- 401k, Roth IRA contributions

- Pay off student, car loans

- Invest in taxable accounts

- Mortgage

Asset allocation

Simple asset allocation strategy I use:

- 25-40: US - 70%, INT - 15%, Bond - 15%

- 40-60: US - 50%, INT - 10%, Bond - 20%, Tips - 20%

- 60-80: US - 30%, INT - 10%, Bond - 30%, Tips - 30%

- 80+: US - 20%, Bond - 40%, Tips - 40%

Note: At the moment, my asset allocation is US - 60%, INT - 20%, BOND - 10%, ABNB - 10%

Track your progress

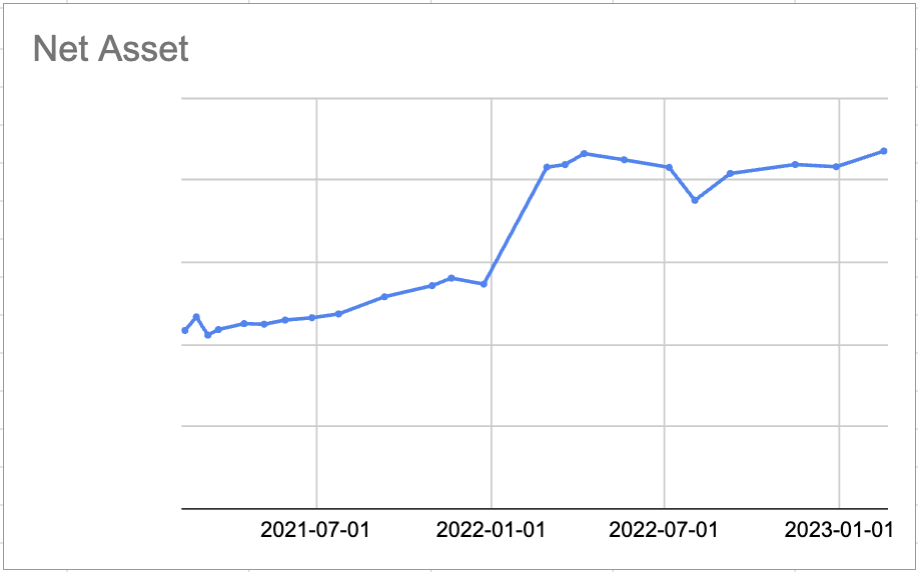

I keep track of my net worth in a simple spreadsheet that I visit & update once every 3 months. You can find sample starters in bogleheads.org/wiki/Tools_and_calculators.

The spreadsheet has several purposes:

- Single place to keep track of asset allocation across multiple accounts

- Calculate asset re-allocation (e.g. sell some bonds and buy stock if percentages are out of the allocation plan)

- Visualize your progress over time:

Fidelity 3-fund portfolio

bogleheads.org/wiki/Fidelity is a great resource for general guideline on Fidelity.

My personal preference:

- US: FXAIX

- INT: FTIHX

- BOND: FXNAX

Minimizing tax footprints

- Use Roth IRA contribution to take advantage of after-tax contribution (no tax on withdrawal)

- Make sure to allocate high growth assets (i.e. stocks not bond) in Roth account to take advantage of tax-free growth

- Place Bonds in tax advantaged accounts (401k) and avoid placing them in taxable accounts

- Think of asset allocation in aggregate level across all accounts, not at the individual account level. It is ok to have Bonds in one 401k account and allocate stocks in taxable.